- 主頁

- /

- About Cashing Pro

- /

- Company Structure

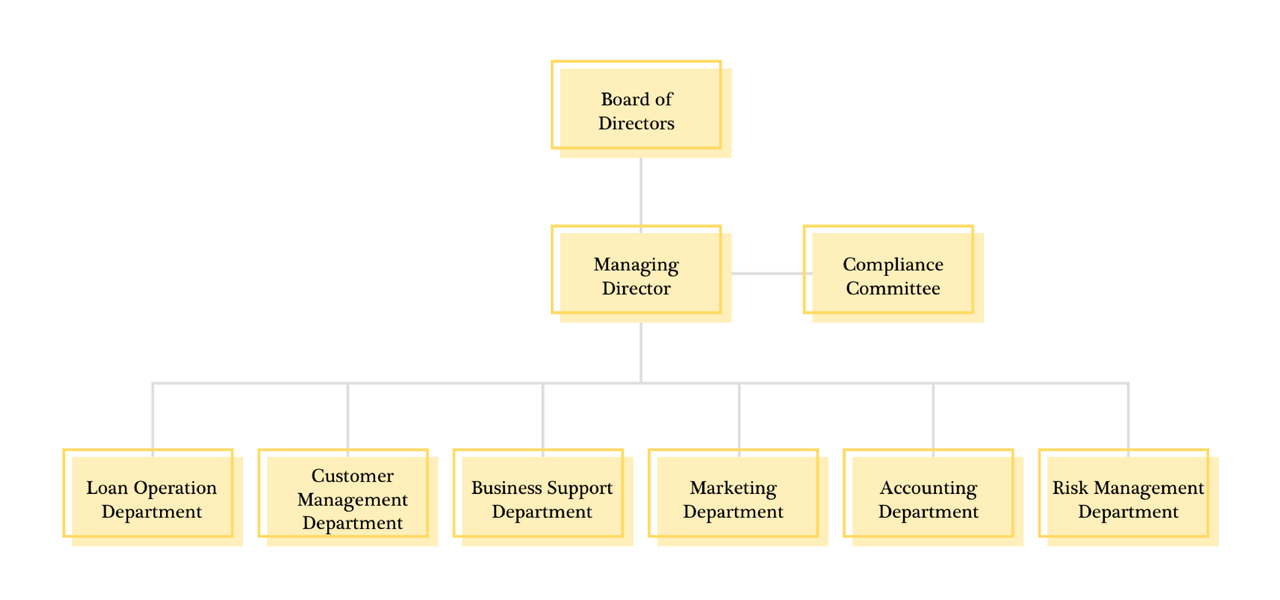

Company Structure

Loan Operation Department

Customer Service Team: Follow up all applications, to provided fast and considerate loan service to customer,

Loan Assessment Team: Use big data analysis to approve suitable personal loan plan to customers, help customers to solve their cash flow needs immediately.

Customer Management Department

Responses of internal debt collection team, including monitor customer accounts repayment record, remind customers to timely repayment. Furthermore, collection team would understand customers’ latest financial situations for introducing them more suitable loan repayment plans and ensuring them they have ability for repayment.

Business Support Department

Business Support Team: The Responsibilities include developing innovative online lending experience and improving loan products to deliver

System Team: Conducting upgrades of Computer system to ensure speedy and smooth loan approval process as well as data security in preventing data leakage and protecting customers’ privacy.

Marketing Department

Promoting the brand for increase brand reputation and sales revenue. Planning and executing online and offline cost-effective marketing campaigns based on the latest market trends and allowing more Hong Kong people know company’s brands, loan products and enhance corporate image.

Account Department

Accurate recording and auditing corporate income and expenditure on a monthly basis; preparing monthly financial budgets.

Risk Management

Performs thorough investigation when abnormal cases are found such as overdue or suspect fraud cases, review the risk and effectiveness of regulations, compliance and anti- Money Laundering (‘AML’) activities.